Saving money. It’s something that we all mean to do, but for one reason or another, often don’t. By focusing more on the expenses we need and a less on the indulgences we want, saving can fall to the wayside. Savings challenges make it easy to visualize and commit to reaching your goals.

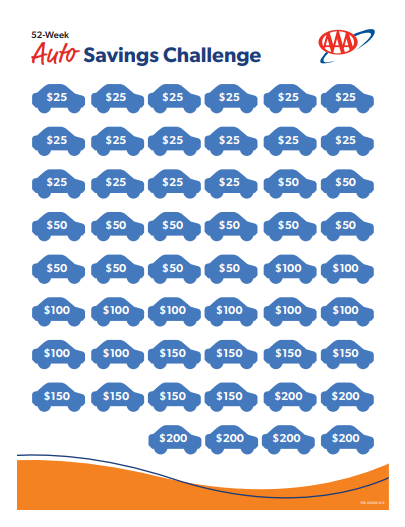

These challenges are designed to help you save money over a specified period of time. Savings challenges come in all shapes and sizes, so to speak. One common type is a 52-week challenge, which requires saving a set amount of money each week over the course of a year. You can start small, saving $5 a week, then gradually move up to larger sums each week.

Aside from accumulating money for a specific financial goal, savings challenges force you to be conscientious of your expenses and spending habits. In turn, you can evaluate what goods and services you can live without and where you may be spending more than you should.

To help you on your journey, we’ve devised savings challenge worksheets for four major purchases that you’ll almost certainly need to save for: a house, college, a car and travel. By following our 52-week savings challenge, you’ll be able to bank an additional $4,400. Depending on your situation and lifestyle, that should be enough to cover a family vacation or a down payment on a car. It can also take a chunk out of your student loan debt or help fund a down payment on a new house.

Saving Money For a House

Pay Off Student Loans Faster

Saving For a Car

Saving for Travel

Once you’ve completed your savings challenges, head right back to AAA. We can help you secure low-rate mortgages, auto loans and student loans, and book that once-in-a-lifetime vacation.